气候活动家社区中的一些人(也许许多)憎恶投资和关注碳捕获和存储技术的注意力,认为它们会减少对全球经济燃料中脱离化石燃料的能源和运输解决方案所需的重点和资金。好用的买球外围app网站有人认为,它甚至使我们对他们的成瘾永久存在。

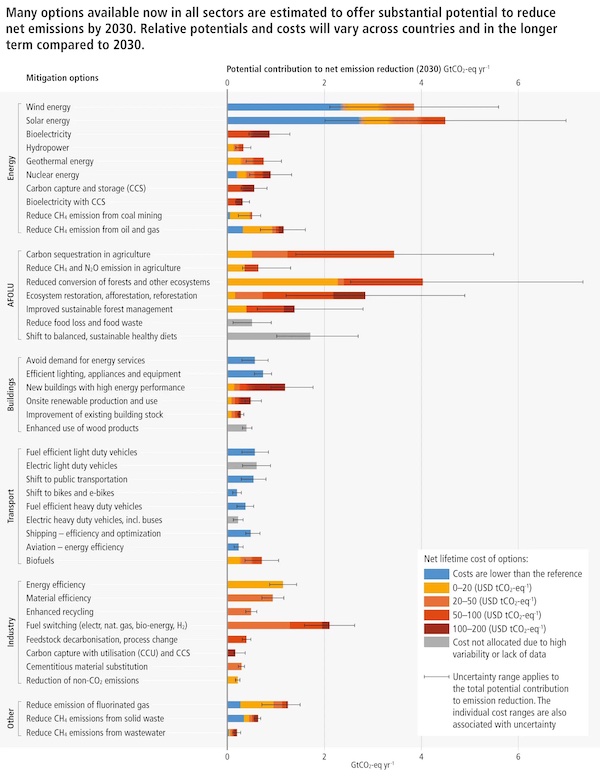

可悲的事实是,上周由科学家强调了latest Intergovernmental Panel on Climate Change report, is that developing ways of removing residual carbon dioxide is also essential to the transition — if we have any hope of keeping global temperature increases below 1.5 degrees Celsius. In fact, we need pretty much every option mentioned in "that" chart they published outlining the various pathways to 1.5 degrees C (below and在这里链接),这是在气候技术界的巡回演出。有人有海报大小吗?

That’s one reason I believe the efforts of companies including Microsoft, Shopify, Stripe and Swiss Re toprioritize carbon removal and storage approaches— rather than avoidance projects — are noteworthy. You could argue, validly, that their carefully curated carbon removal contracts are just an evolution of corporate offset purchasing strategies. And we all know that buying offsets is no substitute for practices that reduce emissions over the long term. But you could also argue, validly, that scaling every approach at our disposal is a wise move.

那是背后的动机the substantial new Frontier Fund这是由软件公司Stripe设立的9.25亿美元的“提前市场承诺”(AMC)投资于碳清除偏移,以及Alphabet,Shopify,Meta和McKiney的资金开始。

该基金本质上是Stripe和Shopify在过去几年中分别管理的计划的更大版本。这两种资金都集中在评估实际从事碳去除碳的早期初创公司,并且在那几个月中都学到了很多东西,他们渴望与其他公司买家分享。

The going-rate for these contracts is generally higher than what a company would pay for many avoidance credits on the market today. When it made its first purchases in 2020, for example, Stripe paid about $100 per metric ton for projects being developed by CarbonCure (the CO2-sequestering concrete company) and $600 per metric ton for work being done by geological storage concern Charm Industrial.

Frontier Fund的重点是帮助扩展每公吨售价低于100美元的解决方案的可用性。它将根据这些标准(除其他标准)评估潜在的拆卸偏移:永久性(二氧化碳将远离大气多久,它寻求超过1000年);特定技术需要的足迹有多大(某些直接捕获选择可以是耗时的);解决方案实际提供了多少能力;它是否真的导致净负面结果并可以这样验证;以及环境正义的影响。

Stripe将努力比作了加速疫苗开发的机制:“ AMC的概念是从疫苗开发中借来的,并在十年前进行了试验。第一个AMC加速了肺炎球菌疫苗的开发for low-income countries, saving an estimated 700,000 lives. While themarket dynamics of carbon removal and vaccines are not identical, they face similar challenges: uncertainty about long-term demand and unproven technologies. AMCs have the power to send a strong and immediate demand signal without picking winning technologies at the start."

最终,该基金计划向其他买家开放。

Frontier是我本周一直在考虑的几种碳除去采购开发项目之一。另一个重大公告星期二in the form of a big "carbon credit purchase agreement" that involves碳技术技术, which has developed a way of injecting captured CO2 into concrete where it is mineralized and "permanently" stored.

The Canadian company, which last year split thetop prize in the Carbon XPrize,已与两家开始对碳信用额进行投资的公司透露了一笔3000万美元的交易。一种新的伙伴关系投资者反转和区块链/加密技术公司Ripple。碳壳carbon removal methodology已获得VERRA信贷计划的批准,该计划使买家可以追踪细节。

Invert plans to make credits from the portfolio available to individuals and other businesses. The contract covers "hundreds of thousands of immediate, permanent and verifiable carbon credits to be delivered over a 10-year period."

Carboncure的企业使命是到2030年每年删除5亿吨CO2,这与每年乘坐1亿辆汽车相同。

这一刻,我的聚光灯中的另一家公司是总部位于旧金山的传家宝, which last month raised one of the largest Series A rounds for a direct air capture company to date — $58 million led by Carbon Direct Capital Management, Ahren Innovation Capital and Breakthrough Energy Ventures, along with the Microsoft Climate Innovation Fund.

传家宝is also one of the startups that has signed contracts with both Shopify and Stripe, both of which are receiving credits for helping boost the technology in its early stages. Other early customers include software companies Klarna and Sourceful and nonprofit Milkwire. The company has raised a total of $58 million so far, including grants from ARPA-E and the National Science Foundation, according to Max Scholten, head of commercialization for Heirloom.

传家宝使用可再生能源来加速一种自然过程,该过程使用矿物质,该过程“渴望”用于二氧化碳,并鼓励他们像海绵一样将其浸泡,将它们变成石头。它吹捧的成本低于每公吨100美元,大大低于其他直接空气捕获系统。Scholten告诉我,传家宝的方法是模块化的,将取决于给定位置的地质存储能力。他说:“我们可以将系统的规模与约束因素相匹配。”它的目的:到2035年去除10亿吨二氧化碳。

When I spoke with Scholten about the approach, he said Heirloom plans to own and operate installations on behalf of customers. Among other things, the new financing will help fund the company’s first commercial deployment, the location of which has not been disclosed. "The goal has to be as low-cost and permanent as quickly as possible," he said.

It’s clear that we need more corporate support for the CarbonCures and Heirlooms of this world — in much the same way that corporate procurement of renewable energy projects helped accelerate solar and wind installations. The Frontier Fund is another big step toward that. The challenge, of course, is how to apply what are essentially a different sort of carbon offset to carbon accounting models. Let’s all hope we can get the math to add up sooner rather than later.